- ARPDAUPosted 13 years ago

- What’s an impressive conversion rate? And other stats updatesPosted 13 years ago

- Your quick guide to metricsPosted 13 years ago

An analytical framework for brand advertising in mobile games

This is a guest post by Kristian Segerstrale of Initial Capital, originally published on their blog.

Initial Capital work with many game companies, ranging from stealth mode yet-to-launch companies to global stars like Supercell. A common theme across all is that user acquisition costs are rising and “we need to figure out brand marketing at some point.” Most mobile games and apps companies are rightly focused on performance based user acquisition (UA) through a Life-time Value (LTV) and Cost-Per-Install (CPI) arbitrage and have a hard time wrapping their heads around how to think about brand oriented marketing in that context. However, as the market matures, getting to a more comprehensive model of marketing is critical for success. As mentioned in my previous post and my keynote at GMIC – I believe this to be a key competitive differentiator for aspiring winners in 2014.

Some background on brand in mobile / apps

John Riccitiello, former EA CEO, and a strong product marketing thinker and investor gave a great talk on the subject of brand marketing at the recent Gaming Insiders Summit – writeup here. His excellent insights are sometimes hard to tie back to a quantitative model of user acquisition and hence get bounced around more quant marketing departments. A good primer on reconciling creative and performance in marketing byMatt Kellie of Supercell is here. But even he doesn’t quite touch on brand.

I think about this a lot and my take on reconciling the subjects based on my cumulative learnings from Glu, Playfish, LOVEFiLM, EA as well as observing Supercell and other portfolio companies below. At EA in particular as EVP Digital including all central marketing I got to work with a really fun mix of super talented folks across both ends of the creative vs performance based spectrum in particular, and it was fun helping bring all elements together into one team and get to one approach.

Three important health warnings :

- Marketing is fundamentally an art as well as a science and the best outcomes will come from creatively minded people respecting the quant wonks and vice versa. We should try to proxy performance with metrics wherever possible but even the most quant minded folks need to acknowledge that not everything is measurable and we need to live with trusting creative instinct. Much like with making games, figuring out the brand-end of app marketing is all about star creative talent more than any formula. Executed correctly metrics will be a great guide for creative – but only that – not a formula.

- The lowest hanging fruit in app marketing will always be getting featured by the app stores (Apple / Google / Amazon) and a series of smart tests of spending mix of UA spend across Facebook, performance based ad networks like Chartboost and video based networks like Everyplay and AdColony. Broader brand marketing will be an important second step optimisation once you have product traction and your main task becomes fighting diminishing returns. I would not start with it – only keep it in the back of my mind as something I need to get to to maximise the potential of the title once the low hanging fruit is exhausted.

- Nothing I’m about to say should take precedence over making a great product. In F2P – games as a service in particular the experience is the brand – whatever you say or do about the game outside of the game will pale in significance over what real players say, share and feel. The job of brand marketing is to augment and share the truth of those experiences and feelings – not attempt to portray them as something they are not.

An analytical framework for “brand marketing”

Just because “brand” is abstract doesn’t mean it can’t be measured as part of a quant driven marketing approach. In fact almost everything in app marketing can be performance based. The trick is to internalise that attributing performance to “last click” only is a misleading view of what’s going on. Just because it isn’t easy to track something doesn’t mean it isn’t there. Somewhere in a consumer’s head there has been a process of “wow – what is that?” (I’ll call this “Awareness”) to “I love this / have to check it out” (I will call this “Interest”) to “give me the link to install” (I’ll call this “Conversion”) and a set of subsequent steps to ultimately become engaged and monetize. The impact of brand marketing can simplistically be modelled as impacting Awareness and Interest (which both drive more people into the conversion stage, as well as driving down CPI for the folks already there). Post install metrics are far less likely to be impacted to a meaningful degree. There is some potential for it to increase trust and thereby spending / LTV but I haven’t seen it personally and will ignore that effect here. (By the way Awareness, Interest and Conversion are just semantics – there are other words you can use, and specific measurements you could use for each, but the principles should remain the same.)

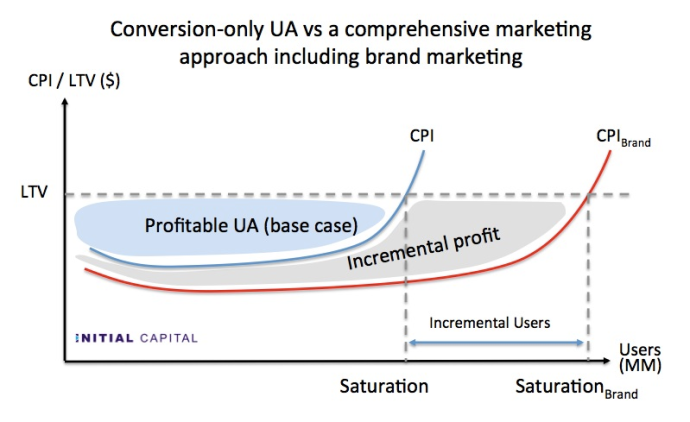

The way the vast majority of mobile app marketing is done today – by buying purely conversion oriented advertising – forces Awareness, Interest and Conversion to all occur in a single step for the consumer. It’s easiest to measure and it is the lowest hanging fruit approach, but will both limit your max growth and achieve it less efficiently. Performance based ad units excel at conversion but are not the best at creating either Awareness or spurring Interest. And the higher these two are, the cheaper the Conversion and the further out it pushes the saturation point where you can no longer acquire users profitably. After all people will only click on the link if they believe it is interesting. A picture illustrating the effect of more comprehensive marketing below. The CPI curve for any segment is lower with broader Awareness and Interest, making UA more profitable and pushing the point of saturation further out.

The reason media mix works is both because it addresses the above steps separately, and also because modern cognitive science suggests that the brain places a premium on the coherence of the information from multiple sources when making decisions. An interesting digression on the topic from Nobel laureate Daniel Kahneman here.

You can a/b test your way to the right creative and media mix it in the long term but it requires a leap of faith initially to try it out. Traditional marketers are more comfortable with leaps of faith than those used to pure performance based numbers. But the payoff for getting it right is huge.

Initially the optimal strategy will almost always be to buy normal performance based ads including video performance based ads which give a better view of the title. You should get the lowest hanging fruit that way. But over time to expand who you reach you need to be more sophisticated. The more core the audience that you are targeting or the more convincing you think they will need to try out your title, the more important it will be to get this right over time. Here is a suggested framework to get there.

1. Develop quantitative targets for your acquisition funnel in terms of Awareness, Interest and Conversion

Awareness: This is the finite universe of your addressable audience or potential players – for example the 240M or so active iOS or Android devices in the USA (Mary Meeker 2013) – clearly the market is global, but marketing is likely to evolve to be more regional. Casual / universal games likely need to target this entire population for awareness. More core / limited appeal games can probably break it down to a smaller addressable audience based on wants and needs. The awareness metric is fundamentally about what portion of this addressable audience is aware that your product exists through organic or paid means. Awareness should always use the addressable audience as the denominator – having a million people who are aware but will never be a valuable user for you is a waste of money. Tools to get there span from TV to online video, social marketing and PR. The traditional outcome metric is Nielsen. It will be interesting to see if a different metric will emerge for Awareness in mobile.

Interest : After hearing about your game the reaction among your potential players should be “yey, where do I get it!”. The tools to generate interest vs indifference are primarily finding a way to show gameplay in a way that evokes a reaction and differentiates the product, as well as using ratings / reviews / stars / accolades to substantiate the message. Finding a way to measure reaction to the imagery / videos beyond click through to actual “rating” is an important area of innovation. The traditional Nielsen metrics of Rating Among Aware (RAA) and Definite Purchase Intent (DPI) used in console are not applicable for F2P. Mobile will likely develop its own more precise rating metrics of what is a favorable rating polling after video adverts and equivalent. An interesting development in this direction is www.loopme.com who have ad units allowing for consumer feedback for example.

Conversion : Understanding the portion of aware users that rate your game that ultimately convert to players and – down the road – paying users. This toolset is well understood and amply supplied by companies like Grow Mobile, Fiksu, Fetch, Mobile App Tracking, Has Offers and others. The basic approach is to test tons of creative and channels, observe the outcome in terms of downstream behavior and then optimize the CPI / LTV arbitrage by channel and demographic.

These target funnel metrics should be informed by baseline organic performance of the title and a sense of what the title is (step 2 below). In this example the assumed initial efficiency loss is 90%. This reflects the fact that any resources spent on making consumers aware that ultimately did not end up satisfying the target condition (here somewhat arbitrarily retention beyond D7) were not deployed efficiently.

Once the marketing campaign is live it is important not only to optimise each conversion step, but also to optimise away from top funnel investments toward audiences / channels that ultimately don’t convert toward a greater focus on those who will. The baseline metrics from beta and early performance marketing efforts should provide assumptions and also begin to refine the view of the target audience to mitigate efficiency loss. At the conversion end this is called ‘look-alike’ targeting – but it should extend to creative and awareness / rating efforts also. A zero efficiency loss is neither possible nor desirable in that a great product will generate awareness on its own, some of which will never convert.

It’s worth noting that there are still very real tracking issues associated with mapping the full funnel above, as well as significant targeting challenges outside of Facebook. This is an evolving space. The solution is a combination of finding creative ways to track the full conversion path for at least a statistically significant number of consumers, as well as being comfortable with econometric modelling where full tracking isn’t available. Initial Capital is actively participating in this space through our investment in app marketing analytics and a/b test provider swrve.

2. Establish a messaging platform – Develop how you portray the game based on the above view of target funnel metrics, respecting exactly what your game is and who it’s for. Develop the high resolution graphic assets, video assets, words you use and don’t use, personality etc based on a combination of intuition and testing. And figure out how to tailor this message and make it resonate with your player base so they will do the heavy lifting on awareness through distribution / sharing to friends for you both through product integration and outside of product on Facebook, Youtube etc. This is a fundamentally a different skill set to performance buys and needs to be as close to the product team as possible. A good example from the console world is Battlefield 4 with the differentiator “Only in Battlefield” based on unique game play features not available in main competitor Call of Duty: Ghosts.

In mobile this is just starting, but the advert below for Candy Crush Saga begins to show how this space is evolving

Genuine viral sharing of assets is still in its infancy on mobile. Solutions by Everyplay and Kamcord to share video clips are charting the path forward here. The holy grail of messaging is to show a tailored, evocative piece of content, endorsed and ideally generated by a friend, on a channel where you are likely to take action. This space will evolve quickly.

3. Establish a channel strategy and model for experimentation – given the metrics framework from point 1 above and the messaging platform from point 2, you can now figure out both 1/ what channels to try out for that creative and 2/ what relative budget allocations to attribute to them and continue to optimise and a/b test your way forward. Once you get some data you can begin to forecast how many impressions across different channels you need to establish the target funnel metrics from point 1, and you can begin to understand what building up to a certain scale will cost you. For example, you should uncover the correct relative level of investment and detailed execution of TV vs online video vs mobile video vs social campaigns and viral sharing features to get to the target Awareness in a similar way as to how you are currently optimising the conversion part between different performance based networks.

It’s critical here that you have a cross channel attribution model that allows you to attribute value not just to the “last click” to install, but rather also to all upstream activities targeting Awareness and Interest ahead of that. Given limitations in data – for example figuring out who saw a TV ad – only some aspects of this can be tested in the near-real time we all love so much. For others you have to be comfortable learning in weeks and months instead of days, and using inferred value through econometrics rather than direct attribution and sometimes testing across countries that tend to behave similarly (like Germany and Austria). But the benefits are huge. If you don’t already have a data scientist on the recruitment list for your marketing team you should probably start looking for one.

It’s worth re-iterating from point 1 that at all times the key is to focus on the folks who ultimately become valuable to you – the highly engaged folks and the spenders. The D7 target is just an illustration for simplicity. The less money you spend on folks who ultimately don’t contribute value in one way or another the better. But the upshot is that brand marketing can and will become a science as well as an art for mobile games. Brand marketing expertise will not determine if your title is successful initially or not, but it will play a critical role in transforming a success into a global lasting winner.

The road ahead

Up to now the fastest pace of innovation in mobile app user acquisition has happened in ‘last click’ performance advertising with mobile ad networks, both in inventory and tracking. The big innovations of 2013 were the rise of mobile video ad networks and most recently Facebook launching their well functioning mobile ad product. We will see more of these in the future, and likely also the rise of real-time-bidding (RTB) in purchasing these impressions.

Some of the biggest innovations in mobile marketing in 2014 will come from enhanced tracking and an increased use of broad marketing strategies. It is interesting that App Annie, one of the leading app store chart tracking services, just launched a basic mobile advertising analytics product in beta – another sign of things to come. Learning will take time and the companies which develop a profound understanding of media mix and their own funnel metrics will begin to build that sought after “publisher leverage” that will create and cement the position of global winners in the market. Count on some exciting years of learning ahead!

Do you have a different view of the direction of mobile marketing? If you do we’d love to hear from you. We think about this a lot – as you can proba